Trailing Stop is one of the extremely effective order management tools, it helps us maximize profits and minimize risks when the market suddenly reverses the trend.

What is trailing stop command?

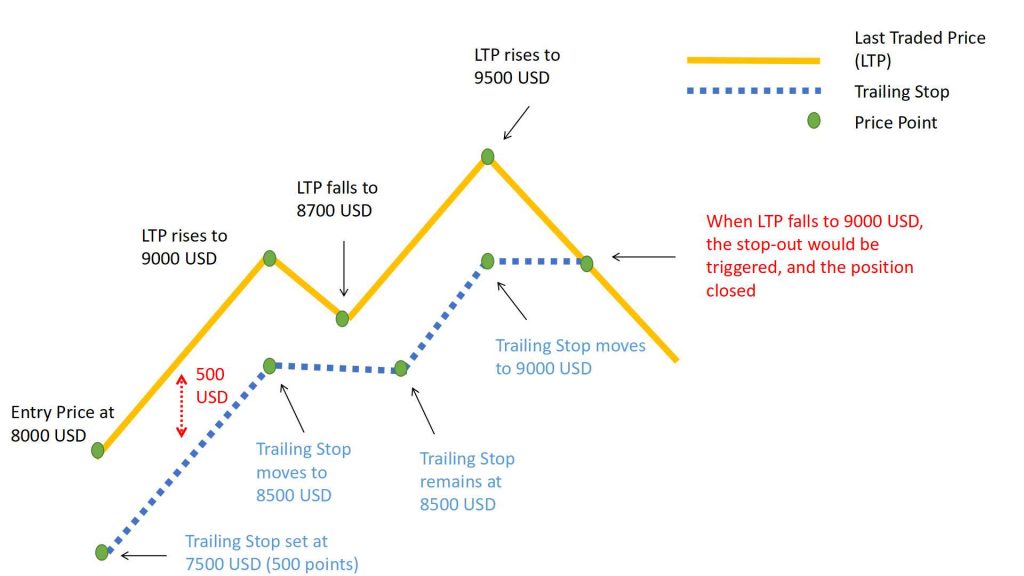

Trailing Stop orders allow traders to place pre-orders at a specific percentage of the market price. It helps traders limit losses and protect profits when trading starts to go in an unfavorable direction with the trader.Trailing Stop orders move in a specified percentage when the price moves smoothly. It locks in profits by allowing a trade to remain open and continue to be profitable as long as that price remains in a favorable direction for traders. The Trailing Stop command does not move backwards in the other direction. When the price moves in the opposite direction to a specified percentage, the stop closes or exits the trade at the market price.

|

|

What is Trailing Stop? |

Is Trailing Stop Stop a Stoploss

Trailing Stop can also be used as a stoploss order however its main purpose is to lock in profits and minimize risks for trading ordersHow Trailing Stop commands work

Traders can place a Trailing Stop order when entering a position in the first place, although this is not very common (not for the purpose of locking in profits but almost identical to stoploss because the order is not running in the right direction at the moment so we do not have a word). Trailing Stop can be placed as a "reduce only" order with the aim of reducing or closing the position.For a LONG trade, a Trailing Stop order will be placed at a price higher than the price on the trade order. Trailing Stop prices will be moved up gradually as a percentage. A new Trailing Stop price will be formed as the price rises. When the price falls, the Trailing Stop order moves. A sell order will be set (put into the order book) if the price moves more than the pre-set callback rate, from its peak price, and reaches the trailing stop price. The trade will be closed with the sell order at the market price mentioned above.

For a SHORT trade, a Trailing Stop order will be placed at a price lower than the price on the trade order. The price of the Trailing Stop order moves down as a percentage. A new Trailing Stop price will be formed when the price falls. When the price rises, the Trailing Stop order moves. A buy order will be set if the price moves more than the rate of capital gains set before the bottom price and reaches the price level of the Trailing Stop order. The trade will be closed with the buy order at the market price mentioned above.

How to place Trailing Stop orders on Binance Future

Some concepts when placing Trailing Stop order on Binance floor

- Activation Price: As the target price at which a trader wants to start running a Trailing Stop order to lock in profits, traders will usually place activation price at a safe price as above the resistance zone (for LONG orders) and support areas (for SHORT orders).

- Callback Rate: % of price recovery, which starts when the price hits Activation Price or another value if the price passes (higher or lower) Activation Price. This section I will tell you more clearly in the instructions for setting trailing stop.

- Reduce Only: The order only decreases, which means that when you accumulate this item the broker will only make a buy / sell order of 1 part or all of the position that you are opening. If you have no open orders, the broker will not make any trades, but only delete the order of the sell if the price runs to the condition of your choice

- Trigger: there are 2 types of Last Price (the closest price traded on Binance Futures) and Mark Price (reference price from another broker). You can choose one of the 2 as the conditional price for the order.

Trailing Stop OrderIng Instructions

Set Trailing Stop order for LONG order

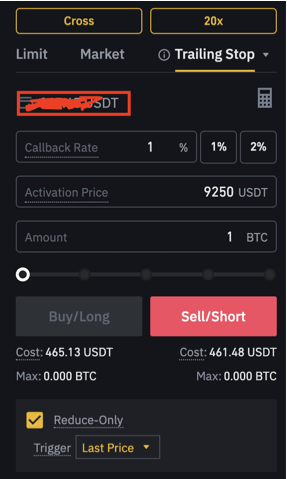

Once you have entered a LONG order, the condition for you to place a Trailing Stop SELL order for this LONG order is Activation Price >= Last Price.For example, let's say I entered LONG Bitcoin at $9170 with a position size of 1BTC. At this point, I will still place a STOPLOSS order as usual at $9000. In addition, I will place an additional Trailing Stop order with activation price parameters of 9250 and Callback rate of 1%

|

|

Use trailing stop commands for LONG commands |

Then I press SELL/SHORT, so if the price moves up as planned and hits the price of 9250, then my Trailing Stop order is activated. At this time, there will be 2 cases, if the price does not rise further but falls again, its order will be closed if the price hits $9157.5 main equal to the value of 9250 – (9250*1%) means a 1% discount from $9250. But if the price doesn't get back to $9157.5 (i.e. not down 1%) then my order has not escaped and Trailing Stop will continue to run if the price goes up again.

At this time the remaining case may occur, which is where the price exceeds 9250. Assuming the price exceeds 9350, the system will now take the price of $9350 to check the condition of the Callback rate. Assuming that from 9350 and the price drops by 1%, we will close the order and close the profit at 9256.5 = 9350 – 9350*1%. But if from the price of 9350, the price does not fall by 1% but only falls by 0.9% and then goes up again, for example, our position has not been closed. So if the price exceeds 9350, the Trailing Stop order takes a new peak to calculate the recovery rate. The price keeps going up without falling more than 1% then the more profitable we will be.

If you notice that the Activation Price input box can be blank, hover over, then we see the message that if it is vacant, Activation Pricewill take the current price as its value . What does this mean? Here we must take into account the moment we place the Trailing order, if after lONG our order has been profitable and is at a safe price, then we can completely empty this item so that the broker automatically sets the current price for us. If they place a Trailing order when they have just finished entering the LONG order, which is not profitable at the moment, we should set Activation Price a little above.

Place Trailing Stop orders for SHORT orders

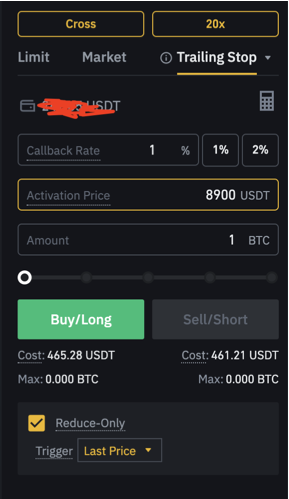

Setting trailing stop orders for short orders is set up in the opposite direction for LONG orders, you only need to manipulate a few times to get used to it. In this example, SHORT Bitcoin at 9100 and target activates orders when the price drops to 9100 and take profits whenever the price rises backwards by 1% but must satisfy the condition that has fallen to 9100

|

| Use trailing stop commands for SHORT orders |